How to outperform in securities lending: You will need two execution strategies

By Peter Bassler, managing director, business development at eSecLending

An investor’s goal is to maximize performance in securities lending within their defined risk tolerances. To achieve this goal, an investor should work with their lending agent to evaluate two execution strategies, 1) discretionary daily lending and 2) exclusive lending.

Most lending agents only engage in lending securities on a discretionary basis; however, one cannot consistently outperform market benchmarks without evaluating both strategies. eSecLending’s unique and proprietary auction process is designed as a decision-making tool to help determine which lending strategy, discretionary or exclusive, is most profitable for a specific fund or asset class in a given market environment.

Discretionary lending – traditional lending where loans are negotiated daily based on demand levels in the marketplace and revenue fluctuates given prevailing rates. Revenue is not guaranteed, and profitability is driven by the negotiated rebate rate on each individual security.

Exclusive lending – a borrower commits to a guaranteed fee (typically for 1 year) that is applied to the lendable market value on a specific portfolio, or subset thereof. All loans that are executed remain one day overnight (“on open”) loans and the client retains all rights of recall for any reason and the portfolio manager has no restrictions. The borrower pays an “access fee” to borrow for a predetermined timeframe, and in addition, each borrow is set at a fixed rebate rate. The revenue stream is guaranteed, predictable and driven by the exclusive fee that accrues daily and pays monthly.

Understanding exclusive lending

Direct Exclusives - Exclusives can be done on a direct basis with a borrower or on an agency basis through a lending agent. In a direct principal exclusive structure, the lender faces the borrower directly from an operational standpoint. Lenders do not have the traditional agency lending protections in terms of price transparency, operational infrastructure and administration, legal agreements or indemnification against borrower default.

Agency Exclusives - In an agency exclusive structure, such as the model that eSecLending facilitates, all traditional agency lending services are maintained so that the legal, operational and indemnification protections are provided to the lender. In addition, agency exclusives, as managed in our model, also achieve exemplary returns for the lender because they are negotiated through a competitive price discovery auction process.

Eighteen years of managing exclusive auctions has proven time and time again that no single borrower is the highest payer across all asset classes and markets. Exclusive lending is best optimized when multiple exclusives are awarded to the highest paying borrower for each segment of a portfolio.

Common conflict between discretionary and exclusive lending

As previously noted, most lending agents commonly lend client securities on a daily discretionary basis to produce a floating revenue stream with daily negotiated rebate rates between their trading desks and approved borrowing counterparties. Agents look for an edge to manage borrower demand to achieve higher utilization and lower rebate rates. They want to show value to their clients vs. widely accepted industry benchmarks (i.e. IHS Markit, DataLend, FIS Astec). With full transparency from these sources, sticking solely with this execution strategy makes outperforming on a consistent basisboth challenging to deliver and, more importantly, difficult to prove and defend.

Given this, why don’t more securities lending trading desks evaluate the exclusive execution route as a complementary approach for certain assets in certain market environments? The reason is that the structure of most traditional agent lending programs is not designed for this multi route-to-market approach. Most pool/queue based lending agents utilize specials value to drive general collateral balances for the entire program. Carving out valuable portfolios for an exclusive arrangement is often structurally disadvantageous for the agent’s “pool” performance even if there could be individual client benefit.

Evidence speaks for itself

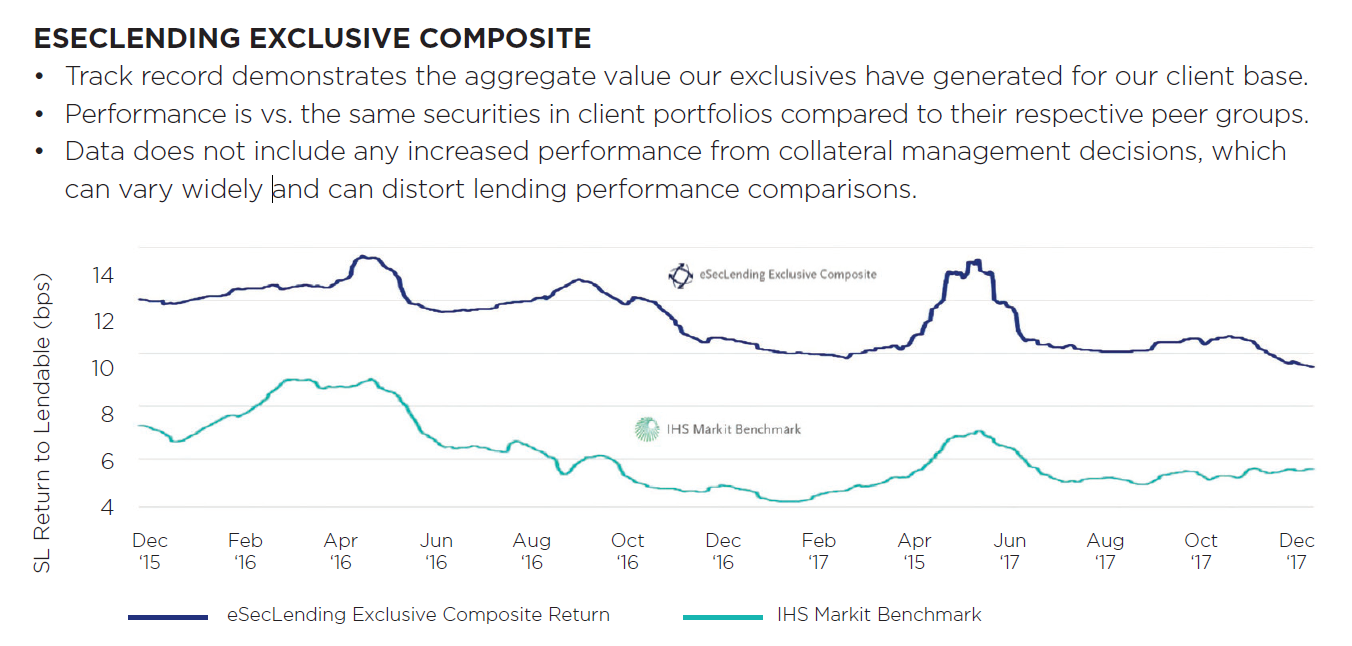

We believe that evaluating both routes-to market is a highly effective strategy and is in the best interest of the lender. The historical exclusive performance we have experienced over the past 18 plus years vs. widely accepted benchmarks speaks for itself. The exclusive execution strategy can be compelling for some assets and needs to be activity considered and evaluated alongside a discretionary lending program.

eSecLending is structurally different than other agents, which allows us to capitalize on both execution strategies. We do not operate a pool or a queue. Each client is managed as a segregated program. Our job is to maximize each client’s performance within their specific guidelines. We utilize all tools to make this happen; our auction provides price discovery and decision making guidance for the lender and based on what the market tells us through the auction (from borrower bids), we execute with both execution strategies thereby optimizing performance.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you