The Case for Managed Futures – with a Few Caveats

By Andrew Beer, founder of Dynamic Beta:

The past few years have not been kind to managed futures hedge funds. The SocGen CTA index of twenty leading managed futures hedge funds has returned a pitiful -0.96% per annum over the three years through June. Despite this, investors should seriously consider increasing exposure to managed futures today given the rising likelihood of a material equity bear market in the coming years. CTAs, after all, were one of the few assets classes to post gains in 2008: up 15-20% when global equities declined 40% along with other “diversifiers” like REITS, high yield, MLPs, and commodities. Investing in CTAs today is the equivalent of buying insurance before the flood, not after.

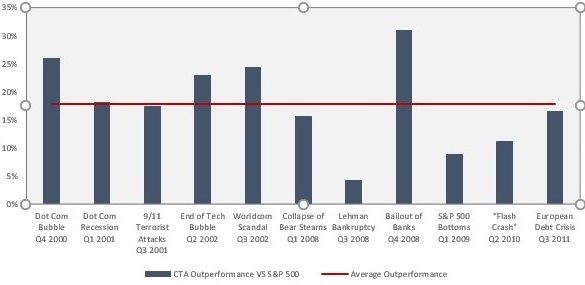

The strongest argument for investing today is that CTAs have performed very well during significant drawdowns in the equity markets. The chart below shows the outperformance of the SocGen CTA to the S&P 500 in quarters since 2000 when the S&P has suffered material losses. During these stress quarters, CTAs outperformed the S&P 500 by 17.8% on average:

The reason is quite simple: most CTA performance is driven by capturing trends – both long and short – and, during periods of market turbulence, multiple asset classes tend to trend simultaneously. Case in point: a factor decomposition of CTA returns in 2008 demonstrates that they made more money in rates and currencies than equities.

There are a few differences, though, between CTAs and other equity risk mitigation strategies. Most risk mitigation strategies are unidirectional – that is, they only make money if equities decline. By contrast, CTA portfolios shift exposures regularly and potentially can generate strong profits in rising equity markets as well. The second, and related, distinction between CTAs and unidirectional risk mitigation strategies is that CTAs have “positive carry” – that is, funds can generate positive returns in periods when equities are flat or rising. The chart to the right depicts the “managed futures smile” and shows the quarterly returns of the SocGen CTA index versus the S&P 500 since 2000.

Despite these benefits, there are several serious issues that institutional allocators need to confront. First, and most importantly, most CTA hedge fund fees are still far too high. While the SocGen CTA index returned 1.14% per annum for the ten years through June, performance before hedge fund fees (and arguably excessive trading costs) was almost quadruple that amount (an estimated 4.46%). More of those pre-fee returns should inure to end investors.

Second, selecting which CTA will perform well going forward is nearly impossible. Empirical evidence shows little, if any, persistence of returns, so last year’s star is just as likely to be in the middle of the pack (or worse) this year. Given the 30% plus annual dispersion between top and bottom performers in space, investors need to diversify across half a dozen or so funds to mitigate single manager risk. Spreading bets, however, reduces negotiating leverage on fees, so many investors end up paying full fees across multiple funds, with commensurately lower performance.

Third, while the long-term correlation of CTAs to traditional assets is close to zero, the active nature of CTA portfolios means that correlations will rise and fall dramatically depending on market conditions. Early 2018 was an extreme example of high positive correlation to equities, where the January equity melt-up produced the best month in years, only to be followed significant losses during the February pullback. This active component makes CTAs more unpredictable; that said, it is a safe bet that they will profit during a protracted and steep pullback in equity markets, when multiple asset classes will be repriced (and trend) simultaneously.

What does the future hold? Large institutions have pressured CTA hedge funds to reduce fees, but often only for “stripped down” versions of their flagship products; anecdotal evidence suggests that some of the cheaper versions have underperformed. Banks offer dozens of dedicated “trend” models through OTC swaps, but performance has been mixed and have done little to improve performance. Neither of those approaches has addressed how to consistently improve performance or reduce single manager risk (or, in the case of bank swaps, “modeling” risk). The most promising area, we believe, is to build reasonable cost portfolios to dynamically capture the core exposures of large groups of CTAs, like those in the SocGen CTA index. By disintermediating fees and some excessive trading costs, we believe that investors can realistically expect to pick up 300 bps or more in performance over time. With this approach, the “positive carry” is much more compelling, and single manager dispersion is materially reduced. For institutional and other investors seeking the risk mitigation benefits of CTAs, this is a clear case where imitation might not only be the highest form of flattery, but also superior to the real thing.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you