BNY Mellon’s Pearce talks trends, Brexit and tech

In the past two decades, the fund management industry that BNY relies upon for much of its income has changed beyond recognition so custody firms like BNY have had to adapt to stay relevant.

While BNY’s clients have battled with tougher regulation and lower fees, the bank is undergoing its own revolution as its new chief executive has started to make changes to realise his vision for the future of the company.

Charles (Charlie to his mates) Scharf became chair of the BNY Mellon board of directors on January 1 2018 having replaced BNY lifer Gerald Hassell as chief exec in July 2017. Scharf was formerly head of Visa where he worked with tech giants such as Apple and Google to turn the historic credit card franchise into a tech-savvy, 21st century financial services institution.

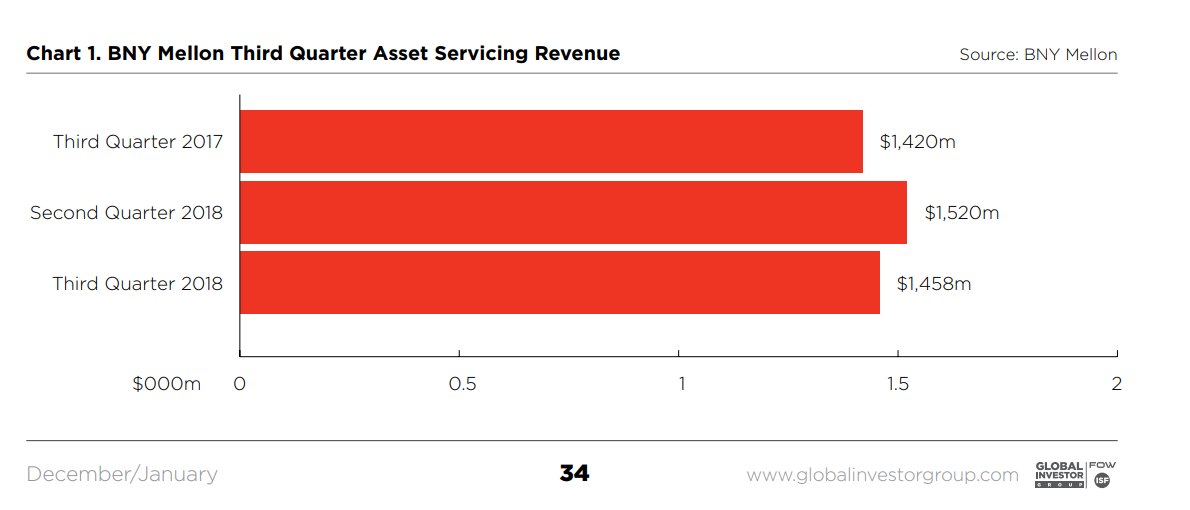

Speaking in October as BNY Mellon reported a small revenue rise in the third quarter (see Chart 1), Scharf was candid: “Our results this quarter were mixed. While we continued to benefit from a reduction in our tax rate related to the new tax law in the US and from strong capital returns, our revenue growth was modest.”

Scharf added: “We did see reasonable growth in some of our businesses and remain confident that we can increase the rate of growth in the others.”

The firm's asset servicing unit saw third quarter income rise 3% year-on-year but fall 4% on the prior quarter to $1.46bn. The bank said in October the year-on-year performance reflected “higher equity market values, securities lending volumes, net interest revenue and foreign exchange volumes” while the quarterly drop was due to “lower net interest revenue, primarily driven by lower deposit balances, and lower foreign exchange volumes”.

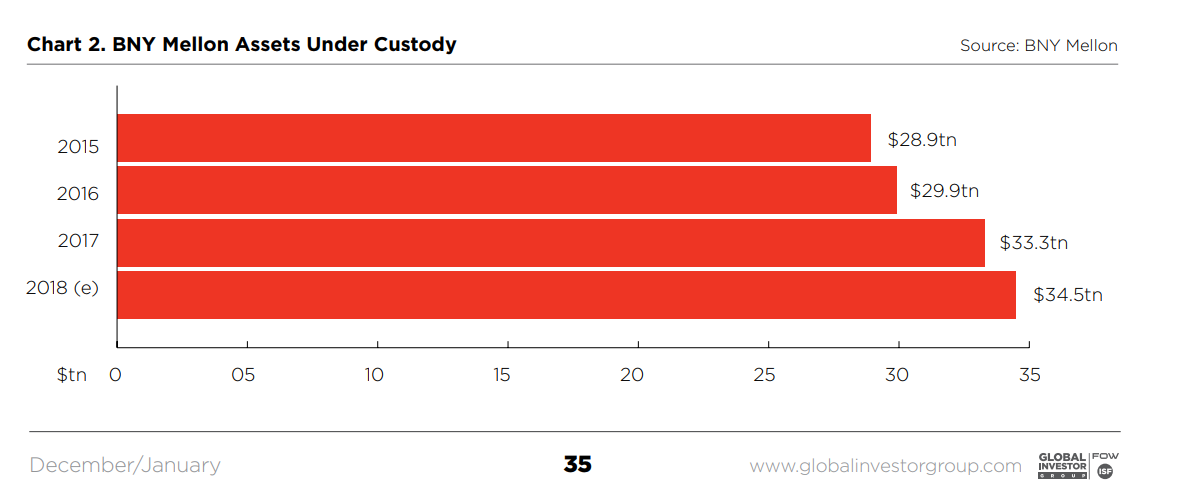

A detail buried in the October results was that BNY became once again the world’s largest custodian (see Chart 2) as its assets under custody hit $34.5tn, just above State Street’s $34tn.

Daron Pearce, chief executive officer of asset servicing, EMEA at BNY Mellon, echoed Scharf’s message when he said the firm is delivering “top line growth alongside careful management of expenses”.

Pearce said BNY has benefited as its largest clients (typically the top asset managers, asset owners or sovereign wealth funds) have in recent years chosen the bank for new mandates or to service more of their existing funds.

He told Global Investor this is a trend on the buy-side: “The biggest, most complex asset managers and asset owners are shrinking the number of providers they work with. No-one wants to have all their eggs in one basket but they’re realising there’s not a lot of point those eggs being in seven baskets, so why not three or four?”

As recently as a few years ago, asset managers wanted specialists in specific asset classes or regional markets to squeeze out a few extra basis points but this era has passed according to Pearce, partly because the largest custodians like BNY have “raised their game over the last five years”.

The rationalisation of providers is a reaction to trends on the buy-side: increased regulation and fee compression.

Pearce said: “The markets have been tough and they

“If much of your discretionary spend is being used on those projects, your ability to invest in front office technology and talent becomes an issue,” said Pearce.

Going Passive

Fee compression is not new to asset management, as Pearce points out, but it has been cast into sharper relief over recent years by the mass adoption of low cost passive products such as exchange-traded funds (ETFs).

Pearce said: “A lot of new mandates are going into passives but there isn’t a great deal of money moving from long-only traditional mandates to passives. The growth is in ETFs and other passive products but it is still small in terms of absolute scale.”

He continued: “We are investing in it because it’s growing fast but the absolute value of ETFs is only around 5% of the total pot so we’re not saying we don’t want to service longonly traditional asset management – that would be suicide.” Pearce said BNY is working to retain its “bedrock” of active funds and compete more effectively for ETF mandates.

Commenting on fee compression more generally, Pearce said: “It

In the meantime, fee compression is forcing clients to lean harder on their service providers.

Pearce said: “So margins get compressed. Rather than taking all that pain themselves, they go to their service providers and say: “We need you to help us”. They don’t use that terminology however, they say it’s time we did an RFP to see who’s got the best service and price.”

The challenge for Pearce and his team is turning these potentially risky Request For Proposals into positives but this is possible, he said, by focusing the conversation on profitability rather than fees.

Pearce said: “One mandate we won was when an asset manager came to market to refresh their technology to handle asset classes they were looking to invest in. We started a conversation around Eagle Investment (BNY’s tech arm) and halfway through that conversation they said: “Can you operate this for us?”

“So the discussion shifted from a software sale to a holistic outsourcing deal where we ended up taking on their middle office and fund accounting, and retaining the services we already had. The unit price of some existing services was compressed a little but the relationship changed immeasurably.”

Brexit

Of course, the biggest immediate threat to any London-based business is the UK’s departure from the European Union and this has been dominating Pearce’s thinking over recent years.

But he believes BNY is in decent shape whatever happens: “We were well structured for Brexit before Brexit was thought of. We are a US institution with a major branch of that institution in London. We have a European bank headquartered in the EU27 and we have a British bank called BNY Mellon International Limited which services the UK and some others such as Middle Eastern clients.”

Pearce said a “small number of contracts” may move from one legal entity to another but “that’s not a major undertaking”.

He also said BNY’s European offshore funds centres have seen a spike in activity since the Brexit referendum “from UK institutions that have exported their Oeic into Europe by launching mirror fund ranges in Luxembourg or Dublin”.

Pearce said the bank is “planning for every scenario”, adding: “We’ve not moved lots of resources out of London or reshaped the business significantly but we are carefully watching the movement of client assets and activity.” He continued: “The biggest determinant will be what kind of deal London gets on financial services. If there is equivalence, it will feel like business as usual. If it comes down a lot tougher than that, I think we will see more control functions like compliance and oversight being built-up in Dublin and Luxembourg.”

Pearce said there have been no examples of financial firms closing down in London and moving jobs en masse to Europe: “But they are saying any growth will be on the continent and there will be a migration of key functions to the continent.”

BNY is keen to expand its business in the EU27 to address anomalies in how its European business has evolved.

Pearce said: “The EU27 is where we need to do more. We need to be in more countries. We are currently on the ground in six EU27 countries and we plan to expand that footprint. There are some big economies but to penetrate the market and build a client franchise you need domestic capabilities.”

He continued: “The funds businesses in Lux and Dublin are significant and fast-growing franchises but there’s a gap and I’d like us to be more relevant to the Italian, French and Spanish markets so we’re looking at how best to do that.” Pearce believes “France in particular is challenging”.

He continued: “The idea of a wholly-owned US bank setting up in Paris and trying to build a domestic franchise, I expect that would be expensive and slow, so we’re looking at more creative ways of getting into that market. That could be an acquisition, a partnership or a lift-out maybe.”

Pearce added: “Italy is more open to foreign service provision and Spain is somewhere between the two. We have plans in play. I’d like to make some progress in 2019, certainly in one of them if not more.”

Daron Pearce has been at BNY Mellon for 18 years in which time he has had risen through the ranks of the US banking giant to become its head of custody for Europe, the Middle East and Africa.

Technology Trends

in asset management and Brexit are not the only challenges facing custodians like BNY however. Technology is evolving rapidly and custodians are must stay at the cutting edge of innovation to ensure they remain competitive.

Pearce said: “One of the things we are proud of is we run global platforms. Everyone says they do but we actually do. We have a single global custody platform so every asset this institution looks after is in a single place.”

He continued: “It would be remiss of me not to mention how focused we are on resiliency and recovery. We’re investing a great deal of money in new data centres and our ability to recover from any kind of cyber or other kind of outage that might occur.”

Pearce said Scharf talks about the objective of ‘five nines’ which mandates that BNY’s systems must be available 99.999% of the time. This means BNY Mellon’s technology can be down for no more than eight hours in an entire year.

The data custodian

Asset management has in recent years taken more and more interest in the role that big data might play in understanding behavioural finance.

“There has been an evolution over the past three or four years with regards to big data. Initially asset service providers thought about how they might use that data to their advantage, what products and services could they build on the back of this amazing data?

Pearce added: “Now, there is a realisation the data belongs to the asset owner or asset manager rather than the service provider. So our mission now isn’t so much how can we use the data to build products for our commercial benefit, but how can we enable that data to be used better by our clients. How can we give them better, more timely, fuller, richer access to their data while recognising that it’s their data not ours?”

Pearce said BNY is focused on giving clients the right tools (such as Application Programming Interfaces or APIs) to access and better understand their own data.

“Instead of being a custodian of assets, we become a custodian of data. That’s how we see the direction going forward, from data, through decisions to ultimately, investment actions.”

Distributed Ledger Technology

Blockchain is another popular subject in the post-trade world populated by custodians but Pearce has a nuanced view. He told Global Investor: “We are an active participant in the main industry initiatives and we are an active user not of blockchain itself but the principles behind blockchain. Some of the underlying principles such as the distributed ledger and immutable stock record are valuable in our industry.”

He continued: “When we became the sole clearer of US government debt, the Fed demanded that we become even more robust in terms of back-ups and one of the principles we applied was that of the immutable stock record. So every ten seconds we create a blockchain-like record of where the Feds positions are. So, in the event our systems went down, and then all our other back-ups went down, the Fed would have access to something no more than ten seconds out of date.”

Yet Pearce remains sceptical: “We’re using the concepts but what we’re not seeing right now is lots of blockchain investment or custody on blockchain. We’re involved in the industry initiatives and looking at crypto-currencies but it’s all a bit theoretical still.”

Roman Regelman, head of BNY Mellon Digital, said the bank is looking at crypto funds but there are outstanding concerns: “We are engaged in dialogue internally and with our clients on cryptocurrency. However, the regulatory framework is unclear and there are many risks, including potential Anti-Money Laundering/Know Your Client lapses, cybersecurity, technological implementation, the capital needed to support market-making and servicing, and general and legal liabilities.”

Regelman added: “As a trusted party, we are willing to support client demand for the asset class, as we have for asset classes throughout our 234 year old history, though currently tangible demand from institutional investors is limited.”

Talent

Financial firms (and others) have in recent years started to think more carefully about their inclusiveness by launching diversity and mentoring schemes.

These should make banks more attractive to a wider range of candidates though Pearce does not buy the idea that financial firms lost their lustre in the financial crisis of 2008.

“Google and Facebook are big pulls for top talent but I still think financial services is up there,” said Pearce. “It may have slipped from number one in the eyes of some but the City is still attractive to a lot of top class University graduates. We don’t have any trouble filling our lists of new hires and internships.”

Scharf has also shown himself keen to shake-up the establishment with fresh blood. He has hired in recent months a new chief of wealth management, a CEO of treasury services, a head of digital, a head of strategy, a head of asset servicing for the Americas and a chief technology officer.

The BNY chief said in October: “We are moving ahead with sense of urgency to improve our growth trajectory. Bringing in new talent to complement the great expertise we already have is critical.”

Pearce has been with BNY Mellon 18 years but, with a new tech-savvy chief onboard, Brexit and secular changes to fund management, the next two or three could be among his most interesting.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you