Reporting regs create opportunity for competitive advantage

By Wouter Delbaere, Singapore-based Regulatory Reporting Director, APAC, for Wolters Kluwer's Finance, Risk & Reporting business.

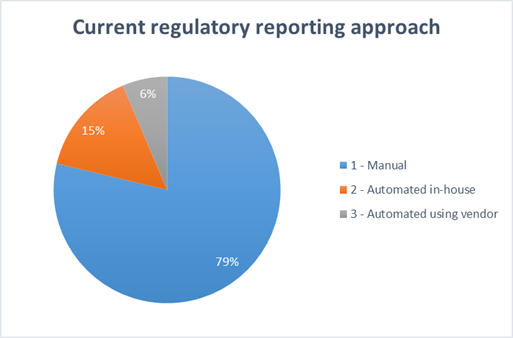

We have been watching the non-bank Financial Institutions very closely over the past couple of years and found that many entities continue to take a largely manual approach to regulatory compliance. For instance, a survey done by Wolters Kluwer with 180 institutions, for 8 APAC countries, covering securities firms, funds, asset managers, insurers, etc., indicates that only about 20% of the non-bank FIs have an automated solution in place for the regulatory reporting obligations:

Regulatory reporting is still typically done via internal spreadsheets and Macros, which gives institutions comfort by sticking to established procedures and spreadsheets, enabling business users to easily visualize and organize data – all at a relatively low cost. But this flexibility is prone to human errors and comes with numerous control risks, a price which many are no longer willing to pay with the extent of the changes recently introduced by regulators, including the recent Securities Financing Transactions Regulation (SFTR) requirements; freely changing or adjusting data, formulae and formatting heightens the risk of errors, inaccuracies or inconsistencies, and makes establishing a clear audit trail difficult. This approach is also inherently limited in terms of extensibility and scale; as the scope of the spreadsheet is extended beyond its original purpose in response to new regulatory demands, the increase in data and complexity will quickly become impractical to manage manually.

Regulations such as STFR will certainly be onerous for FIs, however it also creates an opportunity to achieve competitive advantage for those that are able to implement in a manner that not only meets external compliance, but also generates greater transparency internally, allowing for reduction of regulatory risk and enhanced management information.

The success of this reform and the ability of FIs to adopt them in a cost-effective and compliant manner will depend on the investment in a solution which collects and automates the production of the required regulatory information. The best-positioned banks will be those that upgrade existing infrastructure to collect the additional information required by regulators, while simultaneously consolidating and centralizing this information with other data currently being used for internal and external purposes. A single data repository could then form the basis of all regulatory requirements, including STFR.

Particularly a managed services-type of model would be a good fit, as it would make the overall infrastructure, platform and software costs related to automation much more affordable for these FIs (as opposed to using a traditional on-premise deployment). In 2019 there will be some brave FIs in APAC who will challenge the status quo by taking a managed services route to regulatory compliance, which will be watched closely by their peers and regulators alike. Beyond 2019, it is clear that managed services will slowly, but surely, become a norm, and eventually the way of the future.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you