The elements of investor-friendly securities lending

By Jim Rowley, senior investment analyst in Vanguard's Investment Strategy Group

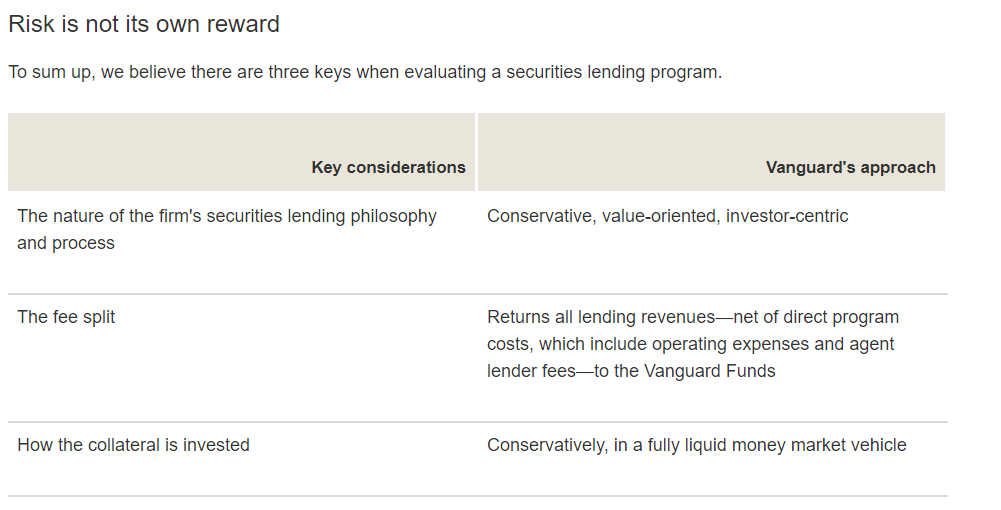

Securities lending can add meaningful value for mutual fund investors. But we believe it should be done in an investor-centric manner, within a strong risk-control framework with the majority of the benefits going to the fund shareholders.

Other fund managers may have a different opinion. Some may use securities lending to essentially leverage the assets of their funds—the assets of their investors—to boost their own revenues.

The result: A sometimes poor risk-reward relationship.

What's a retirement plan to do?

Look under the hood of lending programs employed by fund managers. Make sure the reward aligns with those taking the risk—investors in the fund.

Understanding the basics

Securities lending is a common portfolio activity among asset managers, across both active and passive mandates. Portfolios lend securities, such as stocks or bonds, to broker-dealers in exchange for a fee and the delivery of collateral. The collateral is then typically reinvested by the portfolio managers to earn additional revenue.

However, some asset managers retain part of the revenue, a practice known as the "fee split."

Vanguard takes exception to asset managers using their investors' assets to make a profit for themselves. The investors take on the risk, the firm reaps the reward.

In our case, we run a program that returns all of lending revenues, net of program costs, to the Vanguard funds. By contrast, other securities lending programs may retain anywhere from 20% to 50% of the gross lending revenues.¹

Beyond the revenue split, our approach to the lending process itself is also conservative and serves the best interests of our investors.

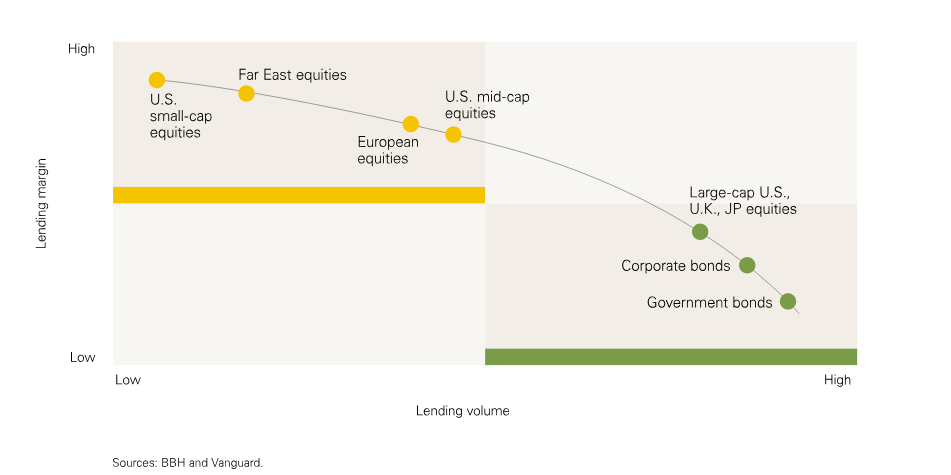

Value versus volume

Generally speaking, the more securities a fund has on loan, the more risk there is for investors in that fund. However, the same relationship does not necessarily hold when it comes to the benefits of securities lending.

Our lending program is value-oriented, which means we lend out scarce securities, such as a smaller biotech firm or a mid-sized pharmaceutical company in France rather than household names. By lending out securities that are harder to find, our loans fetch a premium.

This allows Vanguard to keep the amount of securities on loan lower than in most volume-lending programs which, as the name suggests, utilize less precision and instead lend out a larger portion of their portfolios.

A tale of two securities-lending approaches

We also take a conservative approach to collateral management. We limit risk by investing cash in our Market Liquidity Fund, an internally managed and ultra-conservative money market fund.

Other asset managers may stretch for yield, taking on greater risk for higher income from their invested collateral. That includes how the collateral is invested. That's actually where the risk to securities lending was in 2008 during the global financial crisis. Collateral was invested in riskier securities resulting in a few highly publicized and well-documented cases of losses.²

We strongly advocate for securities lending as a way to offset fees for our index investors. We also advocate for a conservative approach to securities lending where the rewards outweigh what we believe to be relatively low risk. In doing so, the risk-reward relationship is fair and balanced. But that is, unfortunately, not always the case.

In other words, risky securities lending is one of those practices where it works—until it doesn't.

¹ Vanguard review of securities lending practices as disclosed in the Statements of Additional Information found in mutual fund annual reports.

² Adrian, Tobias; Brian Begalle; Adam Copeland; and Antoine Martin. Federal Reserve Bank of New York Staff Reports, No. 529 December 2011; revised February 2013.

Notes:

- All investing is subject to risk, including the possible loss of the money you invest.

- Diversification does not ensure a profit or protect against a loss in a declining market.

- Past performance is not a guarantee of future returns.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you