Are You Leaving Shareholder Money on the Table?

By Peter Bassler, Managing Director, Business Development, eSecLending

In today’s market, even a conservative securities lending strategy can produce meaningful revenue. Lending returns are often concentrated in a few select securities within individual portfolios, which can deliver a high-margin, low volume securities lending program. The portfolio manager or plan fiduciary can dictate the level of participation, program structure, and tailor the risk/return profile to their individual goals and objectives.

Is Lending Worth It?

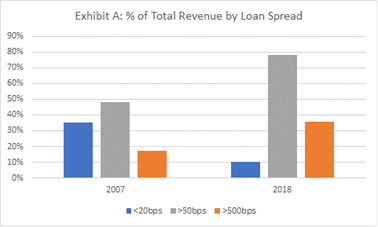

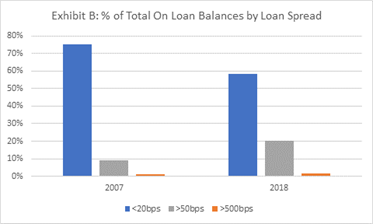

A low utilisation approach, lending only high spread securities, makes a compelling case. Beneficial owners frequently object to the fact that participation in a securities lending program does not create significant enough revenue to justify exposure and resource allocation. However, with highly concentrated revenue, a portfolio manager may only need to lend a small portion of the portfolio to capture the majority of value. FIS Astec Analytics, which tracks data in securities lending, describes the term “super specials” as securities that have more than 500 basis points (bps) of value in the financing markets. If you own super special securities, you only need to lend a few securities to capture the majority of a portfolio’s lending revenue potential. FIS Astec Analytics’ analysis of this phenomenon shows that these high value opportunities account for 40% of global loan revenue (Exhibit A) but account for less than 2% of overall loan volume (Exhibit B). Although the volume figures for super specials have remained consistent since 2007, the revenue contribution from these securities has increased by more than 100% over that time. Current non-lenders could benefit from a re-evaluation of their stance on securities lending given this dramatic shift in the market.

Exhibit A indicates global revenue attribution by loan spread. What is noteworthy is that super specials (more than 500 bps) account for almost 40% of revenue despite, as we see in Exhibit B, representing less than 2% of loan volume. The lowest spread loans (less than 20 bps), on the other hand, represent only 10% of global revenue but account for almost 60% of on loan volumes.

Common Misconceptions and Resistance Points

Conversations with portfolio managers and fiduciary decision makers have led us to analyse commonplace misconceptions, resistance points and why they do not engage in securities lending. Changes in the marketplace in recent years make many of these concerns less relevant and other points of resistance can be mitigated and addressed through the lending structure/ strategy.

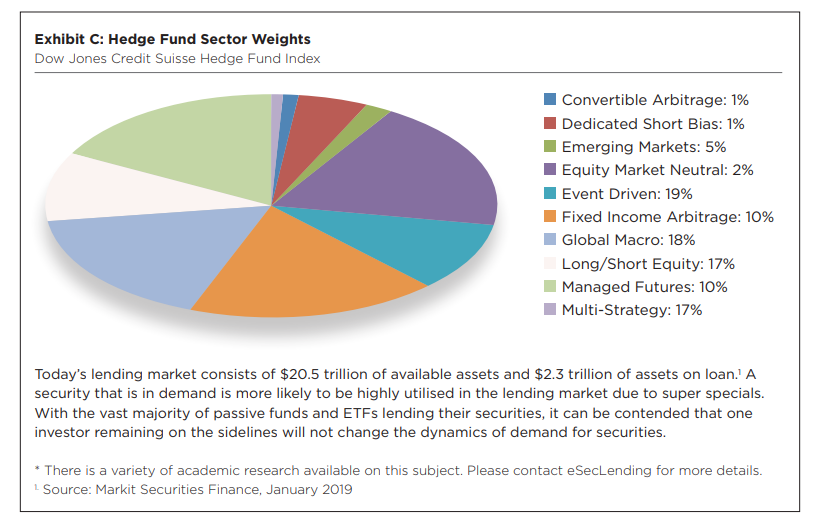

I am a long holder and do not want to help the “shorts.”

Academic research* suggests that short sellers are not the destabilising agents they are made out to be, and often help establish a price floor by covering positions in a market downturn. Short sellers provide a critical component to healthy markets: liquidity. The 2008 credit crisis lent credence to this statement as various regulatory bodies initiated short selling bans that evidence subsequently proved to be largely ineffective and often made things worse, exacerbating volatility, increasing price declines and increasing trading costs. Short selling is often part of a bigger hedging strategy, and it is rare for a strategy to be one explicit bet against a single stock. Below, Exhibit C depicts the investment strategies behind today’s securities lending demand.

There is too much risk for the incremental return.

Today, investors have more flexibility and control over program structure. No two lending programs are alike and different structures have different risk/return profiles. You can elect to lend anything with demand, regardless of how small the spread (for example a general collateral/high volume approach). This latter methodology is referred to as “intrinsic lending,” which has become a much more typical strategy in recent years. As Exhibit A shows, 80% of lending returns come from trades with fees in excess of 50 bps, while representing only 20% of on loan balances in the market. Lending only securities with high fees enables a portfolio to have small loan balances (i.e. exposure) while still capturing a large portion of the revenue opportunity.

The collateral strategy is an added risk exposure in securities lending in addition to counterparty exposure. Collateral guidelines should be reviewed and developed based on riskadjusted suitability and the approach pursued will directly drive the overall risk profile. Securities lending loan transactions are over collateralised, marked-to-market daily and indemnified. As an example, this part of the business generally withstood the tensions of the credit crisis and the Lehman default without any losses.

Collateral risk can be reduced significantly by accepting either highly liquid, highly rated government bond securities or by accepting cash as collateral and applying a very conservative reinvestment profile (i.e. shortterm and highly rated money market funds or collateralised repurchase agreements). Many investors have implemented lower risk cash strategies or have looked to high quality non-cash collateral alternatives since the crisis. If a counterparty were to default, the collateral received in a loan transaction is intended to provide safety. It is imperative that the collateral be highly liquid and retain its value such that the collateral and margin held are more than sufficient to purchase replacement securities, if needed. Risk is created when an investor reaches for yield on the cash collateral reinvestment or non-cash collateral side of the business.

I lose control of my corporate governance right to vote proxies.

It is true that an investor loses the right to vote proxies when a security is out on loan, however, a well-managed program can be structured to allow for early notification and recall for positions where an investor wants to vote a particular proxy, either for a one-off situation or on a systematic all-proxies basis. eSecLending’s program has a partnership with a leading proxy firm to collaborate with investors in how they evaluate the revenue opportunity of lending a security against the competing priority of exercising good corporate governance through an active proxy voting policy.

I do not want to deal with operational hassles and failed trades.

An effective securities lending program should operate methodically in the background, yet all information should be transparent to the portfolio manager. The industry statistics on failed trades are less than 1% even when shares are on loan. If a sale does fail due to delayed return, the fund is never economically disadvantaged because the borrower pays the costs and expenses of fails and buy-ins. Over the last decade, the market has seen significant improvements in automation and standardisation as well as participation best practices. Presently, securities lending is a straight-through process that is operationally efficient.

Evaluate the Opportunity

The idea of securities lending was rejected by some portfolio managers and fiduciaries following the credit crisis in 2008 and 2009. Due to the considerable changes in the market since the credit crisis, this mentality is no longer in the best interest of shareholders and end beneficiaries. Today, revenue is concentrated in a handful of high value names that can be easily monetised within acceptable risk guidelines to capture a majority of intrinsic revenue that is inherent in many portfolios. Portfolio managers and fiduciaries are always challenged to reduce expenses related to managing assets. Securities lending can be an effective way to offset costs related to managing a pension fund, mutual fund, etc. This evaluation can add to the rationale for participation. We suggest talking with a securities lending agent to evaluate your funds’ or asset pools’ intrinsic value to determine the appropriate level of participation and the optimal program structure and approach that suits your goals and objectives. Remember, securities lending does not need to be an all-or-nothing proposition.

Contacts: Peter Bassler, Managing Director, Business Development, pbassler@eseclending.com Simon Lee, Managing Director, Head of Business Development for eSecLending Europe, slee@eseclending.com

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you