So Far, So Good With Libor Replacement

By Kathleen Lynch, Portfolio Manager, William Blair

The London Interbank Offered Rate (LIBOR) is expected to be retired at the end of 2021, and the transition to a new reference rate is no easy task—LIBOR has been in existence for more than 30 years, and is deeply embedded in financial products on a global scale.

But so far it’s been going well, with the Secured Overnight Funding Rate (SOFR) selected as the leading reference rate to replace USD LIBOR in domestic markets.

This is good news for investors because it allows the proper valuation of financial instruments that make up their portfolios.

The Problem With LIBOR

LIBOR is a key indicator of credit market risk and a reference rate for variety of financial instruments. But after the global financial crisis revealed manipulation of LIBOR submissions by some LIBOR panel banks, it became clear that it should be retired.

With LIBOR embedded in more than $370 trillion of securities and five currencies around the world, retiring this reference rate would be a major international event that could not occur overnight.

This is good news for investors because it allows the proper valuation of financial instruments that make up their portfolios.

The United States, United Kingdom, European Union, Switzerland, and Japan have thus been working on a solution to transition to alternative risk-free rates.

Domestically, approximately $200 trillion of financial products are benchmarked to USD LIBOR; 95% of them are derivative contracts. The remaining 5% are loans tied to businesses, floating-rate corporate notes and bonds, securitized products, consumer loans, and residential mortgages.

A portion of these financial products will continue to be outstanding after the retirement of LIBOR. Therefore, without a successful transition to an alternative reference rate, these products cannot be properly valued.

SOFR…

To address the expected retirement of LIBOR, about five years ago the Federal Reserve convened the Alternative Reference Rate Committee (ARRC), a group of private and public officials tasked with selecting an alternative reference rate and constructing a transition plan to that rate.

ARRC selected the Secured Overnight Funding Rate (SOFR) to replace USD LIBOR in domestic markets.

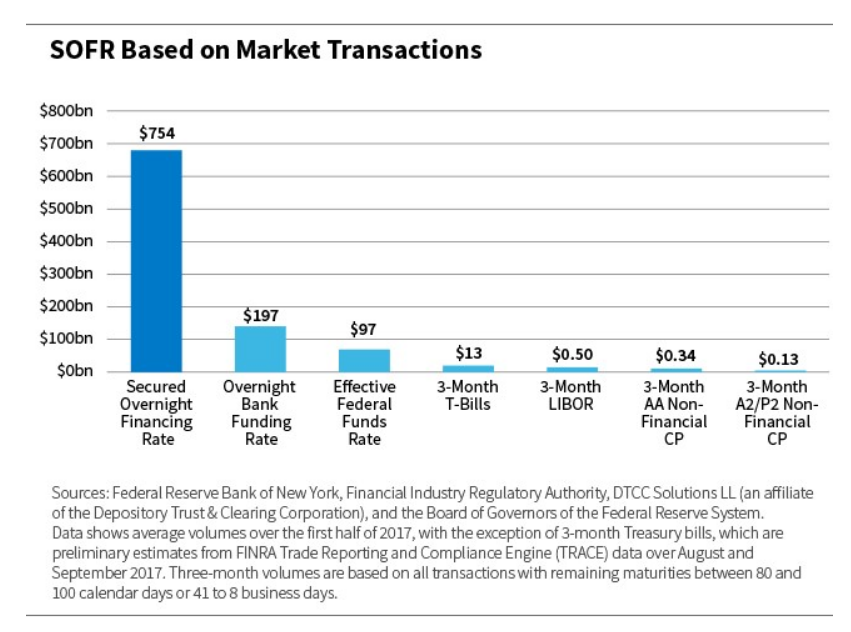

SOFR is a reference rate that is based on U.S. Treasury collateralized, repurchase (repo) agreement transactions, which represents the deepest and most liquid money market in the United States, with more than $750 billion in overnight transactions.

The Federal Reserve Bank of New York began publishing SOFR on a daily basis at the beginning of April 2018, and soon after SOFR experienced a challenge that brought into question its credibility: It was incorrectly calculated.

The New York Fed caught and corrected its mistake, and market participants began to prepare for one of the most significant transitions in recent market history.

Now in motion is a well-defined transition plan that will require cooperation and coordination among all market participants. The goal is to build structure and liquidity for derivatives and cash securities that will be benchmarked off of SOFR.

The New York Fed caught and corrected its mistake, and market participants began to prepare for one of the most significant transitions in recent market history.

Some critical considerations of the transition plan are: the conversion term spread to adjust to an overnight rate from a three-month rate; the conversion credit spread to adjust to a collateralized risk free-rate from an unsecured credit-risk rate; events that would trigger conversion prior to LIBOR’s retirement; and the fallback language outlining the process for the conversion.

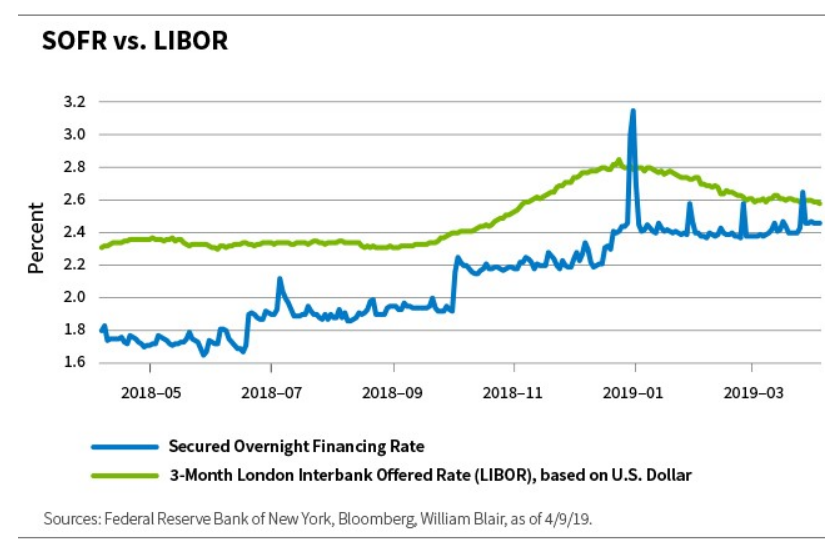

The chart below, which shows the daily resets for SOFR compared to three-month LIBOR, illustrates that transitioning to an overnight risk-free rate from a three-month, credit-risk rate requires consideration for a term and credit spread conversion spread.

Periodic spikes in the SOFR rate can also be observed in this chart. SOFR has experienced month-end and quarter-end rate spikes that give some market participants pause.

One explanation may be related to a growing U.S. Treasury market and bank balance sheets.

Primary dealers, consisting of foreign and domestic banks that are obligated to support Treasury auctions, will demand funding through the repo to support large Treasury auctions. This puts upward pressure on repo rates.

Furthermore, this activity may coincide with large domestic banks backing away from the repo markets to prepare their balance sheets for month-end and quarter-end, putting further upward pressure on repo rates.

Thus, because SOFR is calculated based on daily repo transactions, volatility in the repo market will translate into volatility in the published SOFR rate.

SOFR derivatives have continued to gain traction, with February activity evenly split between one-month and three-month contracts valued at approximately $1 trillion.

SOFR rate spikes were most pronounced during the fourth quarter of 2018, but SOFR quickly reverted to its intra-month range. Spikes in the SOFR rate at month-end and quarter-end are viewed as a technical occurrence rather than an indicator of increased systemic risk.

So Good…

The derivatives and the cash products markets are beginning to accept SOFR as the prevailing alternative reference rate.

SOFR derivatives have continued to gain traction, with February activity evenly split between one-month and three-month contracts valued at approximately $1 trillion.

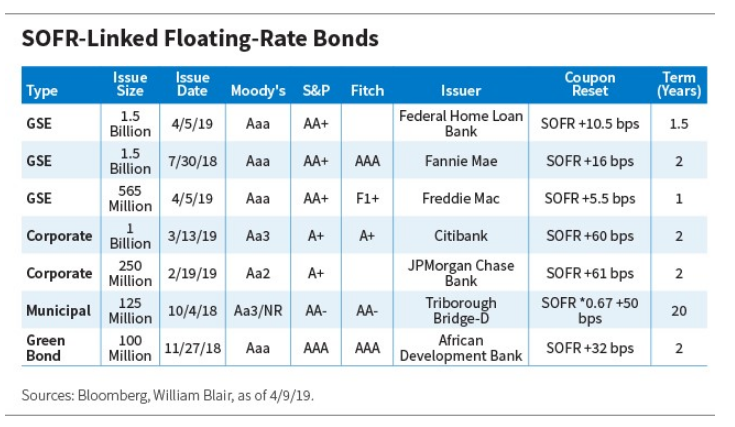

In cash markets, SOFR-linked floating-rate securities have been issued by government sponsored entities (GSE), corporations, and municipalities. The first SOFR linked “green” bond was issued in November 2018. Below is a list of some SOFR-linked floating-rate bonds.

So What?

As noted, without a successful transition to an alternative reference rate, many financial products cannot be properly valued—so investors have a lot at stake when it comes to SOFR’s success.

Although it appears that the transition to SOFR is on track to be completed by the time LIBOR is expected to retire at the end of 2021, market participants still have a lot of work to do to prepare to fully welcome SOFR as LIBOR’s successor.

However, as this is the most significant transition in recent market history and seems to be going according to plan, I think we can say, “SOFR, So Good.”

Kathy Lynch, CFA, is a portfolio manager on William Blair’s Fixed Income team.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you