Repos: A Fresh Look at a Key Driver of Short‑Term Returns

By Jerome M. Schneider, PIMCO's head of short-term portfolio management, and Tina Adatia and Kenneth Chambers - fixed income strategists

Repurchase agreements, or repos, in many ways serve as the underlying plumbing for financial markets by providing a key source of liquidity. A deeper understanding of these building blocks of short-term strategies may also help improve returns.

Repos are a form of short-term funding in which dealers sell securities to investors, usually on an overnight basis or predetermined term, and agree to buy them back the next day with additional interest or premium due to the lender of cash. While repos were in the spotlight during the financial crisis for accounting irregularities, their importance to the daily functioning of global financial markets remains steadfast and evident. We see the need for a renewed focus on repos today for the opportunity they present to invest cash while typically receiving high quality collateral in return, often U.S. Treasuries. Frequently overlooked, the repo market offers investors a real-time barometer of the health of liquidity in global markets and highlights the true cost of capital and funding for institutions and investors alike.

Short-dated assets like repos look compelling

In an aging expansion marked by inverted yield curves in the U.S., the return of market volatility, and anemic average yields for many equity dividends, investors are looking for options that provide acceptable risk-adjusted return potential amid an uncertain global economic outlook. We think short-dated assets look compelling in this economic environment, and specifically favor repos as a foundation of our diversified portfolios given their attractive yield (as we discuss in more detail below), minimal price volatility relative to other securities, and the investment opportunity that a flat yield curve is providing by minimizing interest rate exposure. Moreover, such overnight and short-dated maturities can provide dry powder to take advantage of dislocations that may arise in other sectors of the financial markets late in this economic cycle.

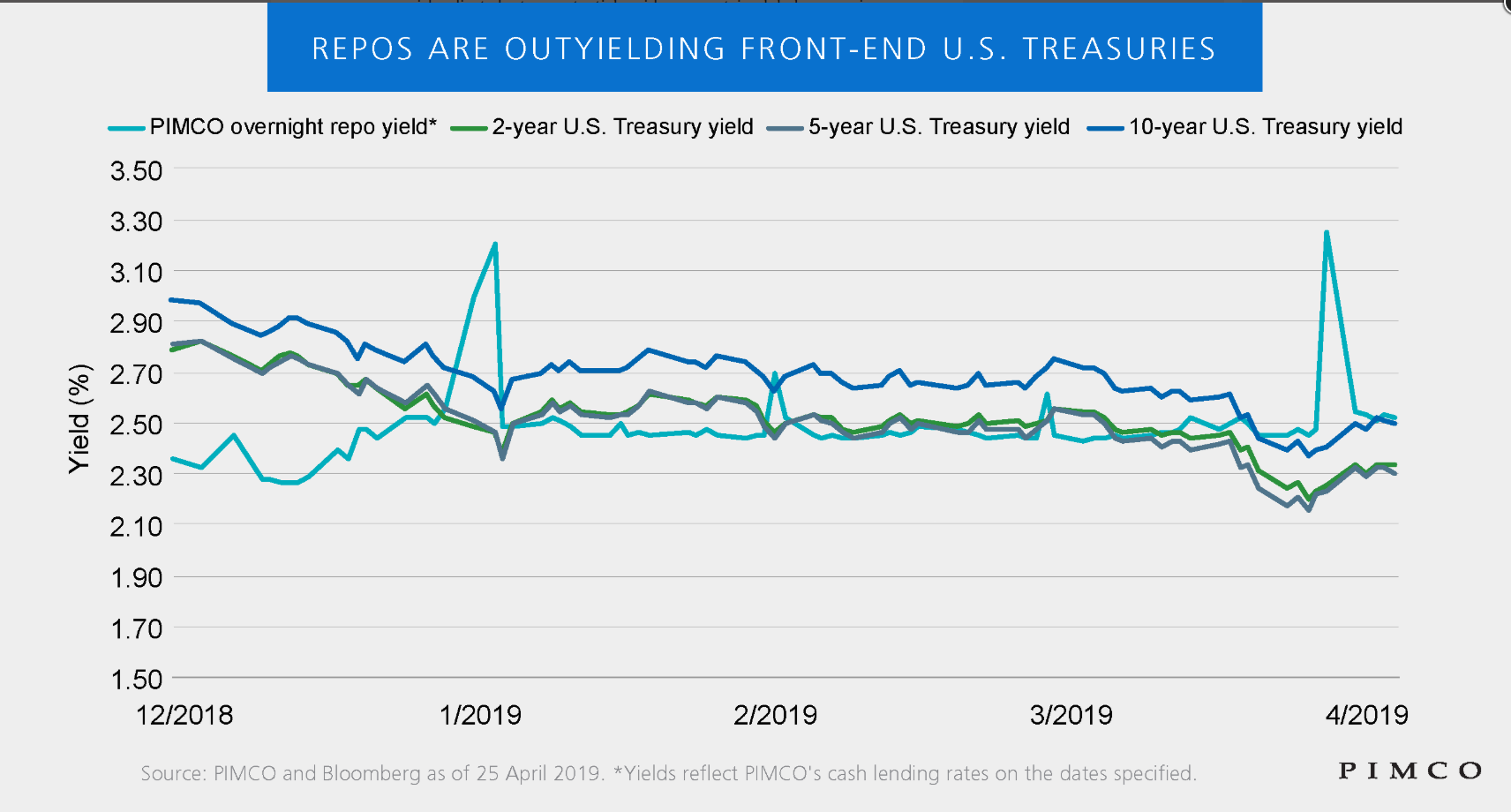

While we believe short-dated rates in general look attractive, rates in the repo market continue to exceed those of many asset classes on a risk-adjusted basis: Overnight repurchase yields, currently around 2.50%, are outyielding U.S. Treasuries with maturities out to 10 years (see chart).

Why would repo yields be higher than those of nominal Treasuries? It’s because many market participants are expecting the Federal Reserve to cut rates over the next one to two years, and U.S. Treasury yields have recalibrated lower recently as a result. If you believe a recession may be right around the corner, longer-duration assets are likely your allocation of choice.

However, if the Fed manifests its stated cautious approach by keeping rates on hold for the foreseeable future, as we expect, then exposure to front-end strategies with a foundation in repos is an attractive proposition versus other alternatives which open investors to greater market volatility. Recent incremental market needs for financing assets, predominantly Treasuries, have also supported higher yields in the repo market, now currently trading above the Fed’s benchmark rate for interest on excess reserves (IOER) of 2.40%.

Not all repo approaches are created equal

Not all repo approaches yield the same results, and we see two key ways for investors to seek value in the repo markets:

- Seek competitive execution. Investment managers often act as both lenders and borrowers of cash at times, which encourages dealers to make competitive markets for them on both sides. This can potentially provide a competitive advantage over traditional money market funds that act as lenders only and may not benefit from the dealer’s incentive to step up yield offers to win the business. Competitive execution by the investment manager helps capture these higher yields, which can be passed on to investors.

- Look for high quality collateral and operations. The method for receiving collateral on repurchase agreements may also provide potential benefits (or drawbacks). We think a framework in which the investment manager places collateral into a custody account on behalf of clients, rather than having it held at a third-party custodian (as with most 2a-7 money market funds), not only offers better protection of collateral; it also may

Although repos benefit from overcollateralization relative to the proceeds lent, like all investments, repos have risks – most notably counterparty risk. And just as clogged or leaky pipes can wreak havoc on a home, disruptions in the repo market can quickly turn into an expensive problem if not addressed, as markets learned during the “run on repos” leading up to the financial crisis. While the media and market participants quickly moved on to more exciting topics once repo markets had calmed, we think they warrant ongoing attention.

Investor takeaways

For investors, the race is on to find income with minimal volatility. With yields that continue to exceed those of U.S. Treasuries with maturities out to 10 years, overnight repos deserve attention.

An active approach founded on a thorough understanding of what drives movements in the repo markets may help investors optimize the attractive and changing dynamics of de-risking higher-risk portfolios into short term investments.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you