ANALYSIS: Competition heats up in Japanese risk-free rate market

There has been a spike in volume in the nascent Tokyo Overnight Average Rate (TONA) futures market this year but senior executives at the two local exchanges vying for market share agree there is more to do to harness the potential of the Japanese risk-free rate.

The first quarter of this year saw a big increase in trading activity at the two Japanese markets that offer TONA futures: the Tokyo Financial Exchange (TFX), which launched its contract in March last year, and Japan Exchange Group's (JPX) Osaka Exchange (OSE), which launched in May.

The OSE saw an average monthly volume of 147,000 contracts in the first quarter of this year, according to FOW data, which compares to a monthly average of just 17,200 lots in the previous quarter. The TFX reported a monthly average of 91,365 contracts in the first quarter, compared with just 33,900 lots late last year.

Kensuke Yazu, general manager at the OSE, said a shift in expectations before the Bank of Japan (BoJ) raised last month its interest rate for the first time in 17 years is part of the story.

“Since January this year, trading volume for OSE TONA futures has expanded, driven by a combination of several factors,” Yazu told FOW. “The change in the BoJ's policy rate has driven some positioning and expectations of further policy rate rises between July and October this year have helped that growth. Behind this, new market participants, including offshore traders and several Japanese domestic institutional players, are also gradually entering the OSE TONA market, which will become the future trend for OSE TONA futures adoption. “

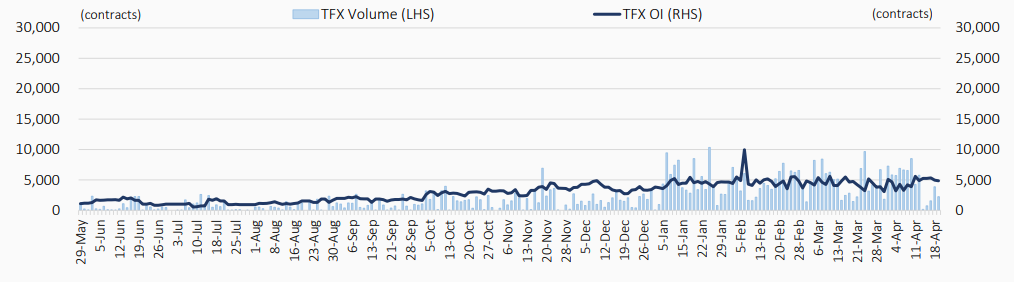

OSE in particular has seen a dramatic increase in volume since the start of the year, in a promising sign for the exchange (see graph 1).

Graph 1

OSE TONA volume and open interest (data to April 22)

The volume shift is also linked to the latest round of market-making and liquidity provider schemes, which came into effect at the start of this year. The OSE has extended its fee waiver programme to September and encouraged calendar spread trading from market-makers, which the Japanese group said has boosted trading of outright contracts favoured by hedge funds and swap traders.

An increase in out-of-hours trading also indicates the exchange has begun to capture international flow from the larger over-the-counter (OTC) market.

“Around 60% of trading for OSE TONA futures is executed during the night session, and many of those transactions happen around New York opening time and London closing time, which are the active hours for swap trading among offshore players,” Yazu said. “So far, more than 20 registered market-makers are covering both day and night sessions and providing market liquidity to OSE TONA futures.”

The OSE on March 4 added cross-margining for OTC interest rate swaps (IRS) that are processed through its clearing entity, adding to the existing offsets available for users of its Japanese Government Bond (JGB) futures market.

“Although the US players cannot access JPY IRS clearing at the JSCC under the existing Commodity Futures Trading Commission regulations, some of them use OSE TONA futures to have JPY rate exposure instead of swaps during the night session,” according to Yazu.

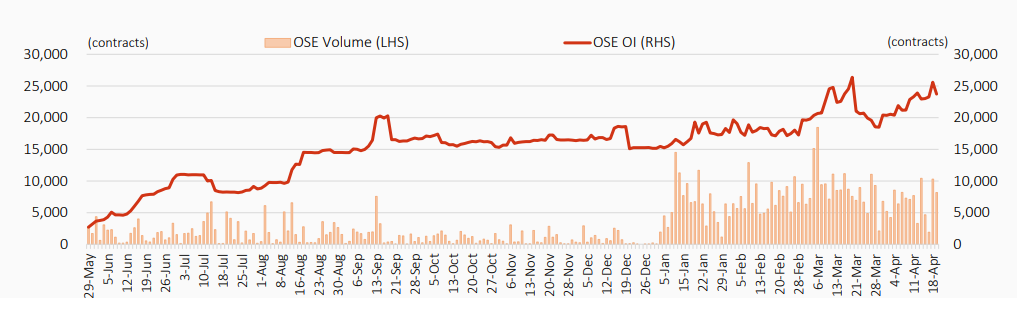

The TFX has also cited its market-maker program for its increase in volumes (see graph 2), suggesting the next phase will be predicated on interest from domestic accounts.

“The majority of the current volume comes from liquidity providers and market-makers so the challenge is to grow the remaining part that comes from real money accounts like Japanese banks, hedge funds and corporate firms,” Ryosuke Seo, director the wholesale business department at TFX, told FOW. “Part of our strategy has been to engage with the onboarding process for those real money accounts, making sure they are technologically able to trade the market.

“We are now at the stage where the interest and capacity could grow even further in line with the shift in monetary policy so there are good signs for growth in this market. So far, the OTC market has been more active, so the direct impact on TONA futures has been muted but the increasing number of new accounts from end users will help divert that flow into listed markets.”

Graph 2

TFX TONA volume and open interest (data to April 22)

Source: JPX, TFX data

The TFX has plans to roll out further functionality. It has a listed option that is lightly traded, but will adapt the expertise and toolkit it developed in its Euroyen product suite to grow adoption with offerings such as packs and bundles, it says.

“One of our strengths has been the offerings of a variety of the exchange-listed strategies that comes from our experience building and growing the Euroyen futures market,” he added. “Calendar spread for TONA futures is also an inherited strength, for example, our implied in and out functionality allows orders to be derived for different spread strategies which can potentially be expected for the positive effect to bid/offer spread. We are also going to extend the strength to packs and bundles on TONA futures.”

While both exchanges have seen a rising trend in open interest, the OSE has maintained the highest rate of growth, peaking at just above 25,000 lots versus the 5,000 level hit by TFX according to data published by both exchanges.

“Offshore real money players, such as hedge funds and swap dealers, are the biggest drivers of this, and their trading flows are essential for the market's development as a source of actual trading demand,” Yazu added.

The Singapore Exchange (SGX) is preparing its own TONA futures launch in the coming months, with an eye on that international demand.

“We do think there is a huge potential for this market, with expectations of a higher rate environment as we launch our contract in July,” KC Lam, global head of FX and rates at SGX, told FOW. “We will be there to help participants who do not have direct and easy access to the Japanese market, to hedge through our platform with the benefit of margin offsets across the relevant products within our ecosystem.”

SGX said in March it is planning a Singapore Overnight Rate Average (SORA) futures launch in the second half of 2024 to trade alongside its 10 year full-sized Japanese government bond future, 10 year mini-Japanese government bond future and 10 year mini-Japanese government bond option.

“We are rebuilding our presence in the rates market because we see an opportunity to build on the demand from our global network of clients who trade our equity, commodity and FX derivatives,” Lam added. “That network should translate into adoption for our planned short-term rates futures, which will complement our mini JGB futures, Nikkei suite and USD/JPY FX futures contract. The combination would allow us to attract a meaningful slice of a growing market.”

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you